Embedded Fintech

I was listening to a podcast by Mike Maples Jr and they had a guy on talking about category creation. This runs along the theme of creation demand vs. capturing demand. The downpayment.gift positioning is definitely about create new demand for mortgage lenders instead of simply capturing it. We are adding value and trying to help buyers become buyers. It’s a completely different idea to the typical lending pitch.

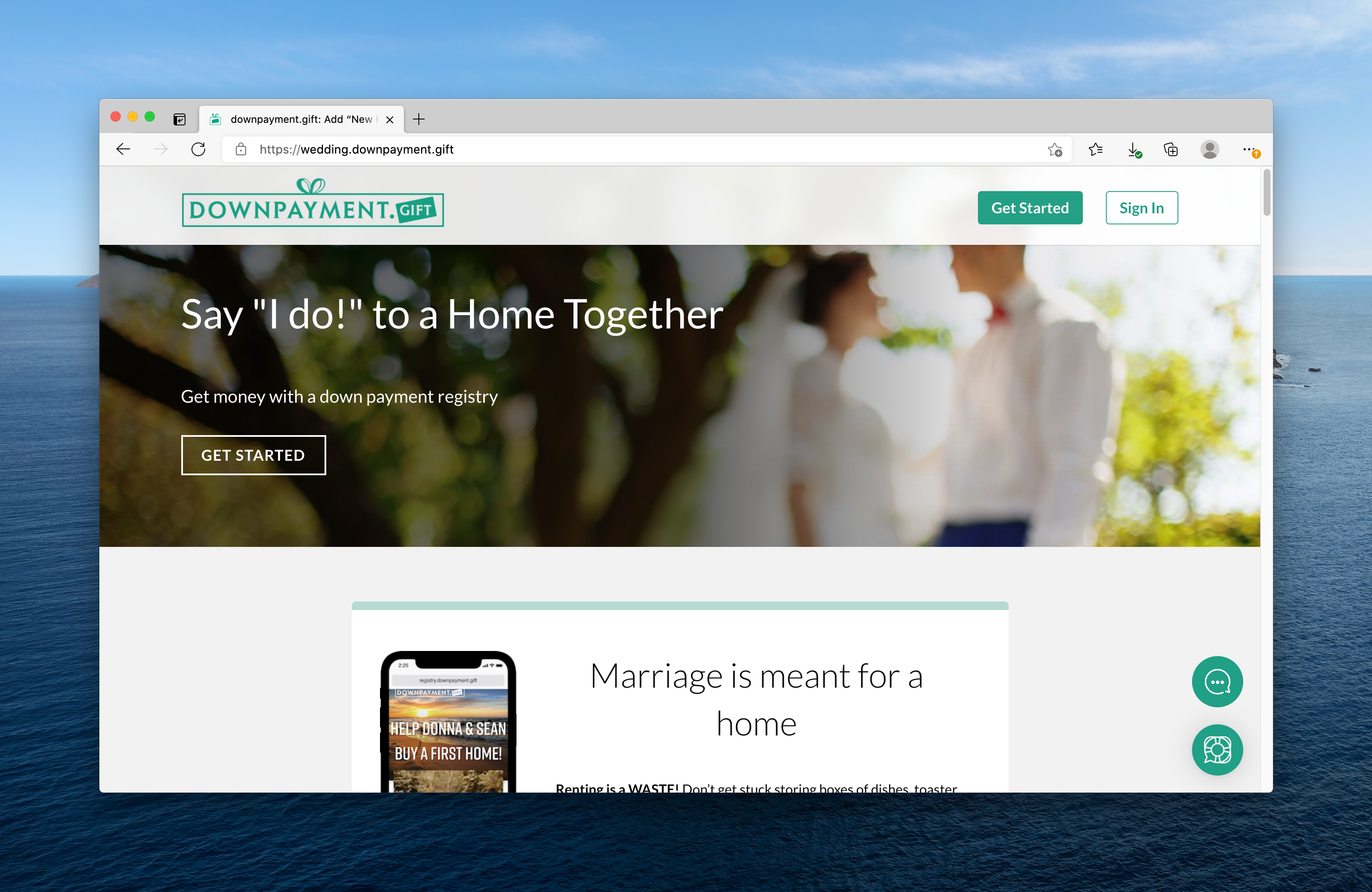

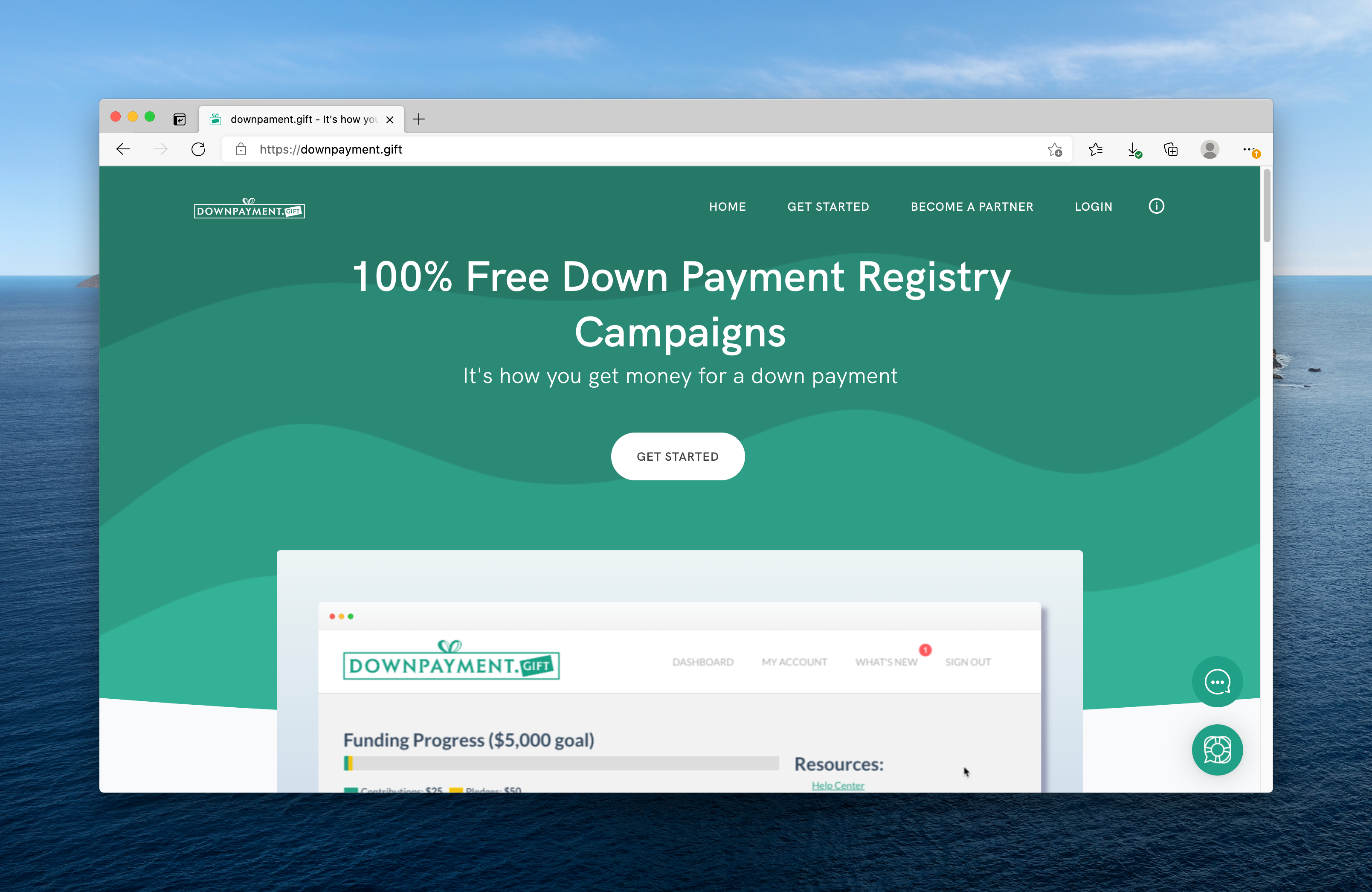

So anyway… fresh off this category creation deep dive… I was listening or reading someone about Embedded Fintech (or Embedded Finance). This is where financial and SaaS providers sell to other businesses or even other SaaS providers and offer financial related apps, API’s and other integrations to allow them to offer a financial product to their customer. I refer to our Lender customers as Partners. This is a side-effect or having a bit of a two-sided business. Clients or home buyers and Partners or lenders. I hate calling it a marketplace. We are not building a marketplace in the traditional sense. It was more like a co-branded, vertical SaaS. (not white labeled, cause the downpayment.gift brand will always be there)

So under this category of Embedded Fintech, we allow Lenders and Brokers to embed the “down payment savings and gift account” product into their offerings (online or hybrid on and offline). We have a roadmap of tools for lenders to further embedding the entry point to the sign up funnel… widgets for homepage, links, buttons, and so on. Curretly, it takes them away to downpayment.gift for the registry gift account. I could foresee a future API centric or custom domain integrations were to looks seamless for lenders/brokers. This more white labeled, while retaining the Powered By co-branding for trust, would be squarely in this Embedded Fintech category.

Some of the “news” and PR writing about this category list some of the most basic of applications as in this category… for example, Blend or any webapp that is white labeled and take the 1003 app and documents could be considered Embedded Fintech. Not 100% sure I would bucket online LOS sytems for taking a loan app as being novel in this category… but okay.

Apparently the Embedded Fintech category has been brewing in the VC or Fintech communitities. Embedded Finance is a parallel category. Apparently offering things like branded debit cards might fall into that category.

The idea of both names… that all platforms or brands could be a Fintech too. …offering financial products to their customers without becoming a depository bank.

I spend a little time research this catergory of embedded finance, embedded fintech. I don’t think that customers are actively looking for this category… but it’s an investor positining.

Instead of being Fintech-lite or Fintech-ish… we can take this “Vertical SaaS” and “Embedded Fintech” positioning. The two-sided marketplace mental model is out the window!!!

Co-branded Fintech aka B2B2C. I had been tossing around this B2B2C acronym, but it’s confusing and marketplacey.

Okay… so we are Vertical SaaS / embedded Fintech. I’ll keep exploring this. I did add this in the Business Model side in the investor pitch deck.

Read More